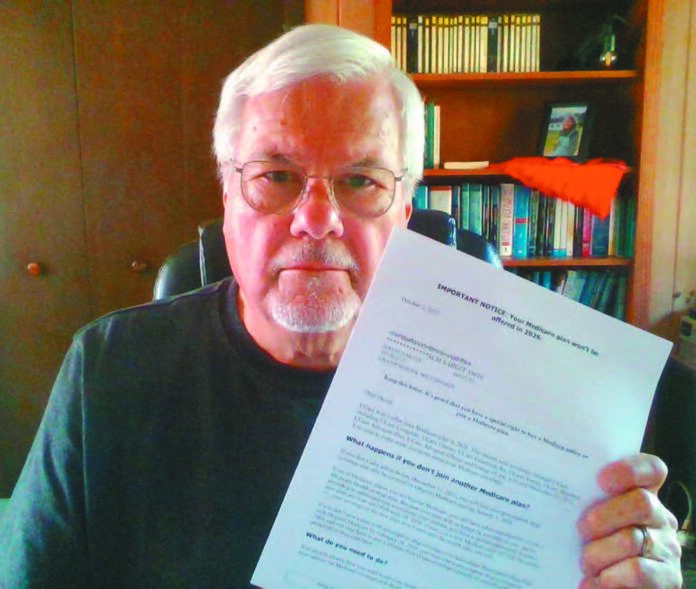

David Harvey got the equivalent of a “Dear John” letter from UCare, his Medicare Advantage supplemental insurance company, earlier this month. He was being canceled. As of December 31, he and 158,000 other Minnesotans would be without anything but bare-bones Medicare.

Moreover, UCare made it clear in their October 2 letter that they would play no part in finding another plan for him. He was on his own. Along with the other 158,000 subscribers.

In a statement to the Northshore Journal, State Senator Grant Hauschild, expressed his displeasure over the move. “It’s disappointing to see this decision by UCare, which will only make it more difficult for seniors in our community to get the healthcare coverage they need,” he said. Adding that the state would do “what we can to ensure seniors have affordable accessible coverage.”

But with less than two months until UCare coverage ends, there is little lawmakers can do.

Advantages of Advantage

Medicare Advantage plans were designed to cover expenses not sufficiently covered by Medicare parts A and B. They typically cover expenses over and above doctors and hospitals. Budget blasters like dental, eye wear, and prescription drugs. There are usually co-pays and set dollar amounts a person pays for all this. For example, $20 per doctor visit. But they go away once you spend an annual maximum requirement. Then the advantage plan pays for everything for the rest of the year.

The hitch-and it’s a big one-is that you can only see certain doctors, hospitals and pharmacies, or “network” of the insurer’s choosing. And, especially in rural areas like Northern Minnesota, that can be a major disadvantage

But for seniors like Harvey, the low monthly premiums for UCare’s Advantage were worth the limitations.

What to do

Without getting bogged down in the alphabet soup of Medicare plans A to F and the six pages of supplement plans included in the UCare letter – David Harvey and friends need to do two things by December 31, 2025:

First, hang on to that letter. “It is proof that you have a special right to buy a Medigap policy or join a Medicare plan,” the cancellation letter warns in bold type.

Next, find a new plan. As of October 15, the official sign-up period began. Not until then were the new premium rates known. Wielding their special letter, UCare castaways can sign up right away.

The trouble is that “right away” might take a while. Minnesota insurance agents are already working long hours helping the first wave of those158,000 soon-to-be uninsured Minnesotans.

Fortunately, free help is available. Aging Pathways, formerly Senior Linkage Line, is a free and well staffed resource where a real live person will match needs and budgets to new policies. Available Monday through Friday, 8am to 4pm at 1-800-333-2433, they can even sign a caller up with a good match.

The computer savvy, or those with children at hand, can compare plans and enroll online at www.Medicare.gov.

Too much of a good thing?

A spokesperson for Aging Pathways told the Northshore Journal that UCare was popular because of their lower than average premiums and extras like prescription drug coverage. But rising healthcare costs eventually turned that plus into a big minus for them in the end.

David Harvey echoed that opinion. “Honestly, I always thought my UCare premiums were too low for such good coverage,” he said. But getting canceled never occurred to him.

“I expected them to raise their rates, not pack up their toys and go home.”

For now he is resigned to the change, although leery of the impact on his budget. “I’m a little anxious for the 15th when we’ll find out what we have to pay for a plan.”