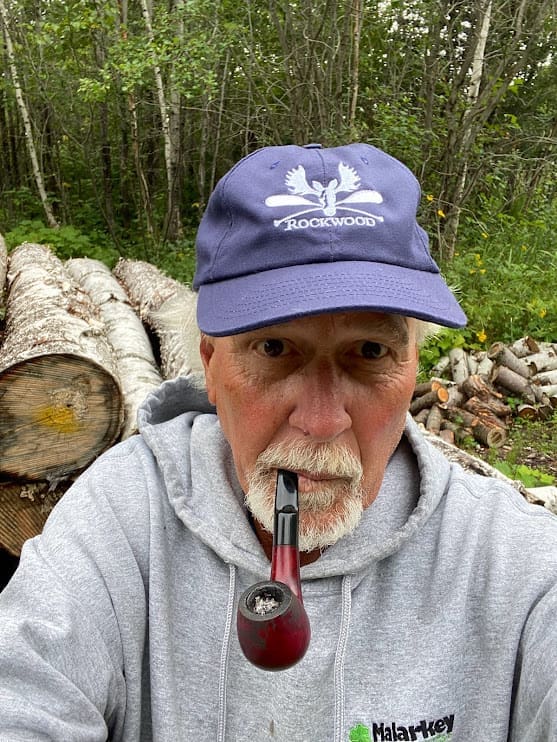

Today the Bohunk celebrates, in a decidedly low-key fashion, the significant birthday that makes us, for the next 49 weeks, the same age. For the most part, she has fared better than I and remains a dedicated watchdog over all things at home, including our rather anemic finances.

Upon returning from the Devil Track Lake in Grand Marais last Sunday, where I’m happy to report I allowed no Spiny Waterfleas to leave the ramp, I found Becky on her laptop. “I’m ‘live chatting’ with Care Credit again,” she growled.

I’ve written about the apparent thievery by bank-owned credit card companies who regularly add extra fees, hoping that enough of us don’t notice and pay them, which just adds to their profits. The Bohunk, to my everlasting satisfaction and delight, doesn’t miss these attempts at theft by the banking scoundrels. Thefts that are largely ignored by regulators and politicians who could put a stop to them.

In the current attempt, Care Credit charged us a finance charge, supposedly for new purchases. There were no new purchases. We have a balance with them in a ZERO interest promotion they did a bit ago. Zero interest means no finance charge.

After the Bohunk used the keyboard to express her frustration at the latest attempt to rob us, the “live chatter” at the bank removed the charge, with no effort to explain what they did or argue that we should pay it.

Synchrony Financial, a US bank with no brick-and-mortar banking operations, owns Care Credit. Synchrony is a major player in the private-label credit card industry, listing billions in assets and millions of customers.

It reported revenue of $21 billion last year, but it is hard to know what part of that turnover was fraudulent fees. Its management was able to eke out $2.1 billion in profit, net income, or bottom line after paying bonuses and salaries—$2.1 billion with a B.

The $4.18 bogus finance charge they tried to slide by the Bohunk isn’t much money compared to $2.1 billion, but it sure wasn’t right. Imagine what part of the $2.1 billion Synchrony made in profit came from bogus charges that weren’t much money but paid by millions less diligent than my bride.

Since I’m revisiting previous topics, let’s take a look at “overtourism.” In May 2022, I wrote about discovering the word overtourism. Like all promising discoveries, this one happened when I was researching something else: the short-term vacation rental market. That column, parked on my website, had over a thousand views—it is my number one post.

A friend of the Northshore Journal in Hovland sent me a clipping from the daily Minneapolis newspaper. It was a Washington Post story about residents of Barcelona, Spain, expressing their displeasure at out-of-control tourism. The article “Barcelona Soaks Tourists” describes disgruntled Spaniards armed with water pistols and carrying “Tourists Go Home” signs.

According to the Post, protesters were affiliated with a group whose name translates to “Neighborhood Assembly For Tourism Degrowth.” The group presented its manifesto, which contained 13 demands. The most interesting demand is “an end to tourism advertisements using public funds.”

Visit Cook County and Lovin Lake County, each use public funds to promote tourism in our region, with quite an effect.

I’m sad to report that I’m hearing from some business owners in Cook County that business is lagging this year. There’s still a long time left, and I hope they see things pick up before the leaves are off the trees. But a broad year-over-year decline demands attention.

A rather anemic winter for skinny skiers, snowshoers, and snowmobilers didn’t help. BWCA closures from wind damage and flooding this Spring have resulted in canceled trips this summer. The rains may have also caused fishermen who would typically come to Cook County to travel to other waters.

Another factor for Cook County to consider is the success of tourism efforts in Lake County and the area around Duluth. Are people getting their North Shore experience without making the extra 100+ mile roundtrip to Grand Marais?

Where did I put my squirt gun?