Last weekend, President Trump announced that he placed a 25% tariff on goods our country imports from several nations, including our largest trading partner, Canada. The new tariff is on top of the existing 14.54% tariff on imported lumber, making the effective tariff almost 40%.

Tariffs are the talk of the political world these days. They are sometimes used as a threat or punishment for a trading partner and often by the government to protect or reward businesses in specific industries. Tariffs on construction-grade lumber imported from Canada are both.

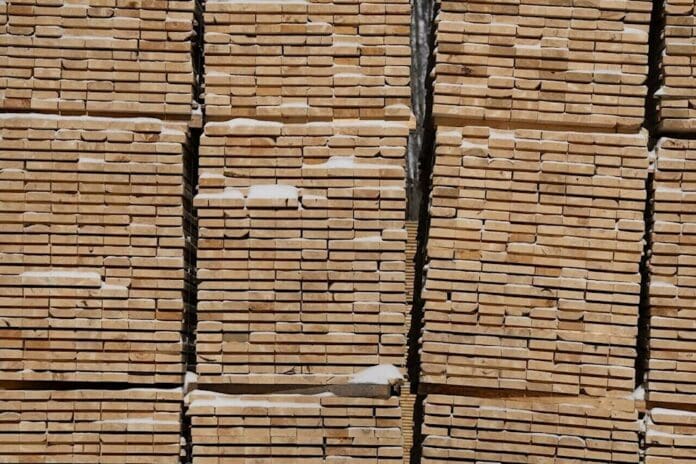

Canada supplies a significant portion of the construction-grade lumber used in the United States today. It is the largest foreign source of softwood lumber for the U.S.

The history of tariffs on Canadian softwood lumber is long and complex, marked by decades of trade disputes between the two countries. In the 1980s, U.S. officials claimed Canadian lumber was unfairly subsidized due to Canadian government policies regarding timber harvesting on public lands.

The 1996 Softwood Lumber Agreement between the two countries aimed to resolve the ongoing dispute by establishing a framework for trade in softwood lumber. However, when it expired in the early 2000s, disputes reignited. The agreement, intended to provide a stable and predictable trade environment for softwood lumber, was not renewed due to disagreements over the interpretation of its provisions and the perceived unfair advantage it gave to Canadian lumber producers. The U.S. again imposed tariffs on Canadian lumber, citing unfair subsidies and dumping practices. In recent years, efforts were made to negotiate a new agreement to address the long-standing trade dispute.

In 2024, the U.S. Department of Commerce announced plans to raise tariffs from 8.05% to 14.54%. These tariffs have been a source of ongoing trade disputes between the two countries and have had significant economic impacts on jobs, businesses, and consumers.

While tariffs and taxes are not the same thing, they are related. While both generate revenue for the government, they serve distinct purposes and have different economic impacts. Taxes fund government operations and public services, while tariffs regulate trade by making imported goods more expensive and less competitive in the domestic market.

Almost ten percent of jobs on the North Shore are in the construction industry, so the increasing price of construction-grade lumber impacts those businesses and workers through higher prices and potential shortages.

The National Association of Home Builders (NAHB) says that softwood lumber prices have been especially volatile in recent years due to increased demand, rising tariffs, and supply-chain bottlenecks. Supply-chain bottlenecks refer to any disruption or delay in the production or distribution of goods, which leads to shortages and price increases.

Natural disasters, such as the hurricanes in North Carolina last fall and the wildfires in Los Angeles County last month, have destroyed thousands of homes. The demand for lumber to rebuild will lead to supply shortages and dramatically higher prices around the country, even without the new tariffs.

Changes in softwood lumber prices directly impact the price of a new home. Lumber and other forest products account for 15-25% or more of the total construction cost for a wood-frame house, and price increases will significantly affect home prices.

Cook County Home Center (CCHC) in Grand Marais is a lumber retailer, the last link in a long supply chain that brings two-by-sixes and two-by-fours from the forest to the sawmill and ultimately to the builders and DIYers. According to Dan Fernlund, CCHC’s Director of Operations, the retail price of lumber is determined based on the current cost of replacing that lumber in the yard’s inventory to achieve and maintain acceptable margins. CCHC adjusts lumber prices, up or down each week, based on price adjustments from their suppliers. Any increase in tariffs on imported Canadian lumber will be passed to the distributors that supply local lumber retailers like CCHC almost immediately, highlighting the immediate and urgent impact of the tariffs on local businesses.

On the morning of February 3, Fernlund was notified by CCHC’s main lumber supplier that every mill they work with was bumping up prices immediately by 25%. To provide some context, Fernlund said that a lowly 2X6 precut stud you could have bought Saturday for $7 will soon cost you $10.30. Between tariffs and sales tax, the governments of the US and Minnesota will earn the most significant margin of any participant in the supply chain on that humble stud that will reside in your wall for years to come.

President Trump and Canada’s Prime Minister Trudeau completed two conversations by Monday afternoon. Based on the Canadian’s promise to appoint a “fentanyl czar” and do some border security, Trump postponed the effective date of his tariff order for 30 days.

Supply and demand, weather events (such as wildfires and droughts), and global economic conditions greatly influence the lumber industry. These factors significantly impact prices and profit margins for businesses in the supply chain. Government action makes an already volatile market even more volatile.

NAHB reported last week that Western Forest Products Inc. cut production in its British Columbia sawmills by approximately 30 million board feet in the last quarter of 2024. The company cited market challenges like weak lumber demand and higher U.S. softwood duty rates.

NAHB quoted Western’s President/CEO Steven Hofer as saying, “With the potential for the combined U.S. Softwood lumber duties rate to more than double in the second half of 2025, all levels of government need to be focused on creating a policy environment that supports the forestry industry and encourages domestic investment.”

NAHB continually tracks the latest lumber and futures prices and provides an overview of the behaviors within the U.S. framing lumber market on its website. On January 24, the week-to-week framing lumber composite price fell 0.5%. Despite the drop, lumber prices are 9.6% higher than one year ago and will increase dramatically now that new tariffs are assessed.